More and more growers and chain parties are using ‘parametric climate insurance’ instead of conventional weather insurance. “This form of insurance is also gaining ground in Europe,” observes Client Director Ard van’t Veer of risk and insurance consultant Aon.

© AonArd van’t Veer

© AonArd van’t Veer

“Both benefits are weather-related, but they are two completely different products,” says Ard. “In the case of conventional crop insurance, the insurer looks at the actual damage. Take a case of flooding, where potato rot has occurred. The insurer is then informed, and a process follows where the grower has to prove and calculate the damage. The big advantage of this conventional method is that you get an actual picture of the damage suffered by the farmer as a result of the precipitation. But there are also drawbacks. For instance, it is a time-consuming process, and it can sometimes take months before compensation is actually received. If, as a grower, you do not have a stock position or liquid assets to fall back on to sow again, you can face a serious issue in the following years.”

© Aon

© Aon

Parametric climate insurance, on the other hand, relies on data from weather stations and satellites, among others. For example, if rainfall or drought falls below or above a certain level, and that element forms the trigger agreed upon beforehand, you automatically get paid a set amount. This makes the settlement process much simpler, because apart from the weather station, the insured party, and the insurer, there is basically no other party involved. That seems very simple, but there is also a risk, especially for growers with smaller areas. The weather station must be close to your cultivation site. And in an extreme hailstorm, the grower on one side of the village may suffer a million-euro loss, while the grower on the other side has no damage at all. Sometimes rain or hailstorms are very localised, which can work both ways: no damage but a payout, or damage with no payout.”

© Aon

© Aon

The Global Risk Management Survey is a global survey that Aon periodically conducts among companies and organisations to understand the key risks they experience and how they deal with them.

“We see that this form of insurance still has a small share among growers themselves, but among companies further down the chain that take out insurance, it is gaining ground. This also applies, for example, to Dutch importers, who use it to cover crop damage from their overseas growers. These companies depend on the product availability of their suppliers for their contractual arrangements with retailers, and they want to ensure their continuity. Another reason why more and more companies are opting for an insured risk solution is due to the ESG performance of the company.”

© Aon

© Aon

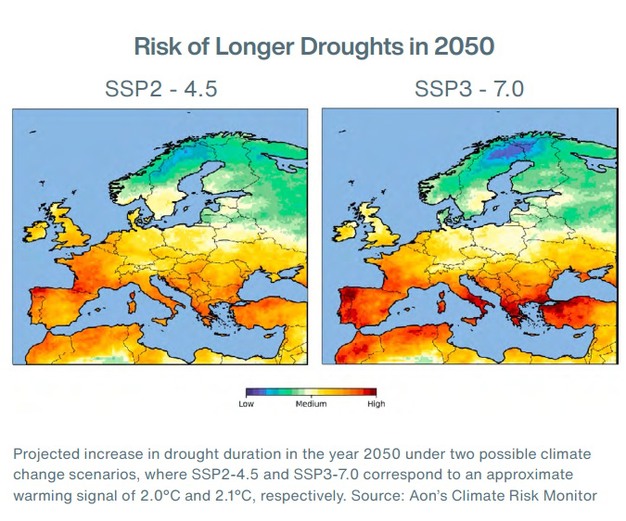

Scenarios of 2 possible consequence situations if temperatures rise further.

© Aon

© Aon

“Dutch fruit growers can usually insure themselves just fine, but you see that large importers of overseas fruit, for example, are more likely to work with internationally operating brokers. Such a quick payout is particularly interesting in countries with extremely large cultivation areas. With only a few hectares, this form of insurance is often not an option, but if you depend on the supply of hundreds of hectares of melons or pineapples, it is very attractive to have money quickly available in case of a calamity. Moreover, due to climatic changes, we are seeing increased investment in weather stations, and the recording of climate data is becoming increasingly accurate,” concludes the Client Director.

© Aon

© Aon

© AonFor more information:

© AonFor more information:

Ard van’t Veer

Aon

[email protected]

www.aon.nl

Source: The Plantations International Agroforestry Group of Companies