With the 2025/26 blueberry season ongoing, Peru’s export structure continues to show high concentration and defined regional leadership. A small group of exporters controls most shipments, while La Libertad and Lambayeque maintain production dominance. The sector combines scale, logistics coordination, and specialised trading windows to sustain supply to destination markets.

Export concentration and logistics strategy

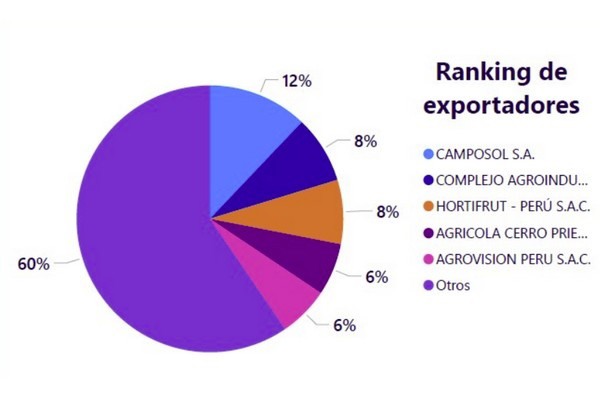

By week 42, shipment rankings reflect the concentration of export activity among leading companies. These firms manage retail programs, consolidation capacity, and shipping schedules. The weekly export curve and accumulated totals reveal faster output growth than in the previous season, prompting exporters to adjust tactics in real time. Measures include advancing or spacing harvests, reinforcing cold chain operations, reallocating ports according to customer programs, and maintaining product consistency across shipping weeks.

The data also highlight operational performance differences among exporters. Some accelerate output during peak weeks while maintaining specification standards, while others modulate volume to preserve uniformity. This balance between volume and quality directly influences shelf life and price stability in destination markets.

© Blueberries Consulting

© Blueberries Consulting

Ranking of blueberry exporters (week 42): High concentration and weight of the “Others” block

Regional structure defines calendar and logistics

La Libertad and Lambayeque remain the main production centres, with Ica, Lima, and Ancash completing the national production core. Regional differences in microclimate, orchard age, and management systems define the timing of harvests and the varietal mix reaching international markets.

Year-on-year analysis by region shows where output is expanding, where logistical bottlenecks are emerging, and what adjustments are needed along the supply chain. These range from improvements in harvest scheduling and cold segregation points to adjustments in port allocation and shipment frequency. Coordination between fieldwork, packaging, and export programs remains central to maintaining supply alignment with retail requirements.

Volume, timing, and operational balance

At week 42, cumulative exports show a faster pace than last season, with higher volumes requiring tighter temperature management and quality segregation. The weekly data sequence, rises, plateaus, and adjustments, serves as a guide for tactical decisions on harvest timing, cold storage allocation, and redistribution between ports and airports depending on destination requirements and transit duration.

The 2025/26 campaign demonstrates that Peru’s blueberry sector operates on two main fronts: Scale and precise timing. Business concentration, regional differentiation, and weekly export cadence demand close coordination between harvest, cold chain, and logistics to ensure measurable quality at destination and maintain long-term buyer confidence.

Source: Blueberries Consulting

Source: The Plantations International Agroforestry Group of Companies