In a country often hailed as the cradle of winemaking, where lavish feasting is elevated to a point of pride, it comes as no surprise that agriculture and horticulture yield a bounty of delicious offerings. In fact, some believe the country’s very name may be rooted in farming; “Georgia” in ancient Greek translates to “agriculture.” That said, other theories also circulate, such as the Arabic-Persian term Gurjistan, meaning “land of wolves,” or a possible link to the country’s patron saint, St. George.

Whatever the origin of the name, Georgia’s fertile soils and diverse climate zones – ranging from subtropical and Mediterranean along the Black Sea coast, to alpine in the mountains, and continental in the east – create ideal conditions for cultivating a wide variety of fruits and vegetables. These include greenhouse crops and root vegetables as well as grapes, blueberries, mandarins, stone fruits, pome fruits, and various nuts.

Fruit shop in Tbilisi with churchkhela, a traditional Georgian candy-like snack made by dipping strings of nuts in thickened and dried grape juice.

Currently, Georgia is a net importer of vegetables. While exports of both vegetables and fruits remain relatively modest, the country’s potential for growth in the fresh produce sector is significant. This is reflected in the upward trends seen over the past few years. Unless otherwise noted, the figures below are based on data from Georgia’s National Statistics Office (Geostat).

Vegetables

In 2024, Georgia exported vegetables worth $19 million, a 42% increase compared to 2023. Imports, on the other hand, reached $71 million, up 17%. Georgian vegetables were shipped to 15 countries, with Russia leading the pack (accounting for 38%), followed by neighboring Azerbaijan and Armenia (a combined 43%), and Ukraine (15%). Exports to the EU were nearly negligible, making up just 1.5% of the total.

In absolute terms, vegetable exports remain modest. For comparison, Greece, which is roughly twice the size of Georgia and has three times the population, exported $210 million worth of vegetables, ten times more (source: European Statistical Handbook 2024, average 2024 exchange rate). Georgia’s vegetable imports come mainly from Turkey, Iran, and CIS countries (former Soviet republics such as Kazakhstan and Uzbekistan).

Fruit

Fruit exports totaled $236 million in 2024, marking a 14% increase year-over-year. Imports stood at $143 million, up 40%. Georgia sourced its imported fruit from 60 countries, with Ecuador (bananas), Turkey, the United States, Iran, and several CIS nations as primary suppliers. The Netherlands (mostly as a transit hub) accounted for 5% of Georgia’s foreign fruit supply, while other EU countries collectively provided a similar share.

Georgian fruits and nuts were exported to 58 countries, with Russia taking the largest share (42%), followed by EU countries (29%, mostly Italy, Spain, Germany, France, and Poland), and neighboring Armenia (11%). For comparison: in the same year, Greece exported fruit valued at €1.3 billion ($1.4 billion), six times more than Georgia.

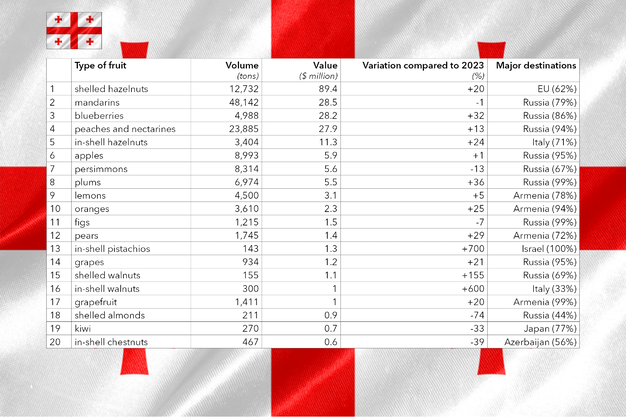

In recent years, vegetable cultivation in Georgia has seen a slight decline, while fruit and nut production has surged. In 2024, the fruit and nut export market was driven by the following key products and destinations:

While the majority of Georgian fruit is still destined for Russia, exporters are increasingly eyeing opportunities in the European market. According to the news platform EastFruit, high logistical risks, inconsistent customs procedures, a lack of legal safeguards, and a volatile Russian market are pushing exporters to look westward. When prices are comparable, the EU’s greater market transparency, legal predictability, and lower risk of non-payment can tip the scales in its favor.

That said, exporting to the EU comes with its own set of challenges, namely the long distance, the strict standards imposed by supermarket chains, and the relatively small production volumes, which make it difficult to break into the retail sector. To overcome these hurdles, the Georgian fruit industry will need to further professionalize and consolidate. Greater cooperation among growers and exporters – possibly through the formation of cooperatives – could be key to unlocking that potential.

Source: The Plantations International Agroforestry Group of Companies