Moving about his clients, looking at the data on each farm on their platform called IMPI, it’s clear that during November, the evapotranspiration in Western Cape table grape vineyards has been markedly higher than the November before, says Danie Kritzinger, an agronomist with particular interest in table grapes at Agrimotion. “The feedback on the early grape varieties in the Western Cape indicates a lighter crop as a result of the excessive heat during November.”

The water lost from the plants (evapotranspiration, or ETo) during November 2025 was even higher than in February 2024 and February 2025. “We’re not accustomed to a November that is this hot,” he says. The winter came to a sudden end in August, and where irrigation was not altered to account for the higher evapotranspiration, vines would undoubtedly have come under water stress.

Western Cape dam levels are dropping as farmers are upping their irrigation. In De Doorns, the situation is still fine, he says, but in the areas around Ceres and Clanwilliam, as well as in the Klein Karoo, farmers are very concerned about water. The Olifants River – the same river that has twice in recent years cut Citrusdal off from the outside world – has recently stopped running.

© AgrimotionWestern Cape vineyards experienced higher evapotranspiration during the early summer of 2025/26 than the year before

© AgrimotionWestern Cape vineyards experienced higher evapotranspiration during the early summer of 2025/26 than the year before

High temperatures are expediting the ripening of grapes, and when irrigation doesn’t keep up with requirements during the period from fruit set to colourbreak, the immediate effect is smaller berries. “Along with that, quality could be compromised by reduced absorption of elements like potassium.”

On the other hand, overirrigation will lead to an imbalance between acids and sugar, resulting in reduced shelf life and eventually food waste.

“At Agrimotion, our constant message to producers is around the importance of using the correct information to make informed decisions when it comes to irrigation monitoring and scheduling. The minimum requirement when setting up accurate scheduling would be a reliable weather station, regular soil moisture observations – at least once weekly per block – done with a soil auger or profile pits. But also, crucially, a crop factor that is flexible depending on the phenological stage of the particular cultivar.”

Kritzinger adds that soil moisture probes assist in improving the accuracy of data, but cannot be used without weekly soil moisture observations.

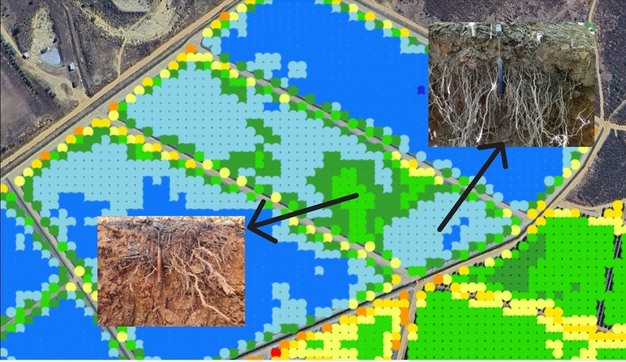

© AgrimotionDrip irrigation necessitates a different crop factor from micro irrigation; right, profile pits for an accurate picture of root depth and soil moisture observation

© AgrimotionDrip irrigation necessitates a different crop factor from micro irrigation; right, profile pits for an accurate picture of root depth and soil moisture observation

Crop factor not de facto irrigation schedule

The adaptable crop factor is one of the functions of Agrimotion, and it forms the bedrock of knowing how much water the plant is consuming, to therefore work towards its replacement. “Crop factors give you the water usage, and they are quick to show up trends, but they are not an irrigation schedule by themselves. Scheduling is further affected by soil qualities, root depth, and the means of water delivery: we’ve found that drip and micro irrigation systems require different crop factors.”

Because crop factors speak to water usage, it’s a good indicator, along with evapotranspiration. The product of the two factors is the block’s water usage, and it’s been clear, he says, that during weeks 44 to 49 of 2025, evaporation figures were notably higher than over the same period a year before.

He continues: “Fruit crops cultivated on ridges also require more water and therefore might be managed at a higher crop factor than a block next to it without ridges, even if it is the same variety and rootstock.”

There is consensus that the Western Cape is entering another period of drought. The question is, rather, how far they’ve proceeded down this next cycle of drought. “Are we there yet, or do we still have time to prepare?”

© AgrimotionRoot depth strongly influences irrigation strategies, as shown by this screenshot from Agrimotion’s IMPI platform: strong growth, the shades of blue are the zones where roots are 60cm to 80cm deep, while the roots in the light green zones are only 30 to 40cm deep, thus more vulnerable to heat waves

© AgrimotionRoot depth strongly influences irrigation strategies, as shown by this screenshot from Agrimotion’s IMPI platform: strong growth, the shades of blue are the zones where roots are 60cm to 80cm deep, while the roots in the light green zones are only 30 to 40cm deep, thus more vulnerable to heat waves

![]() For more information:

For more information:

Danie Kritzinger

Agrimotion

Tel: +27 73 703 45 88

Email: [email protected]

www.agrimotion.net